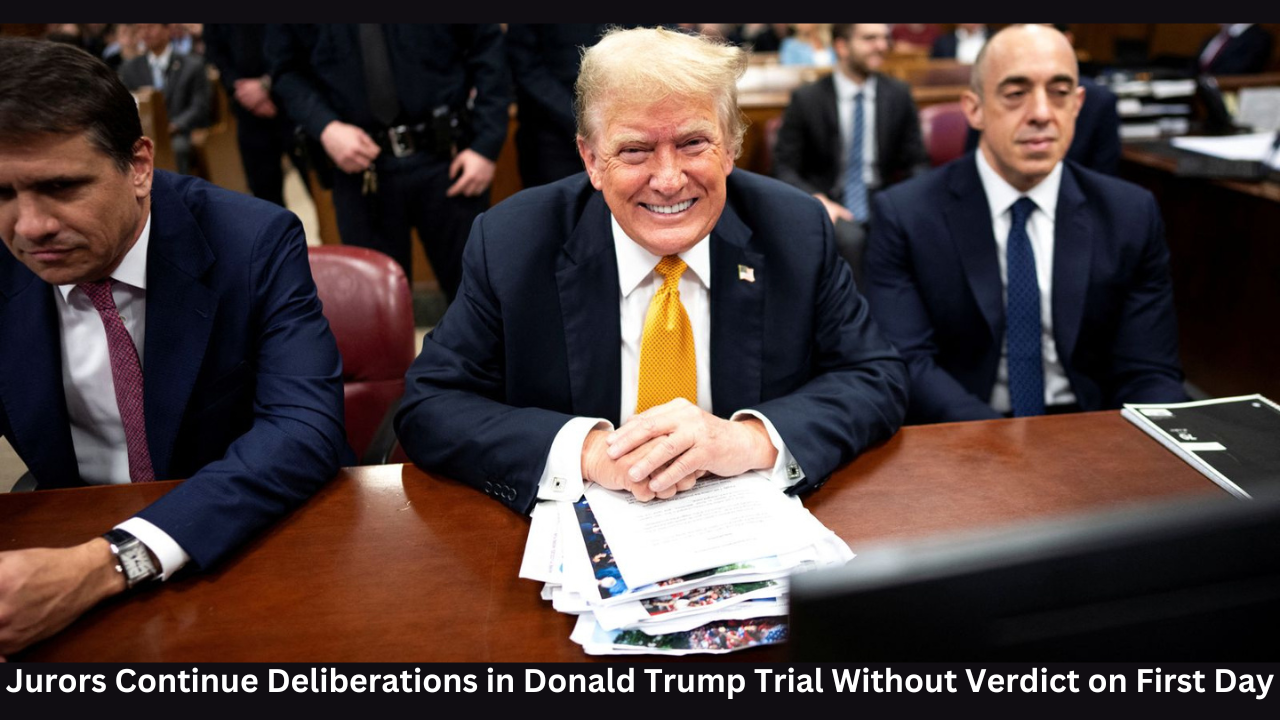

Markets mark Mr. Donald Trump‘s return, and the former president is standing fortified in his efforts to take a credit-worthy position in business.

Digital World Acquisition Corporation, a public company shell which shareholders reconfirm for Trump’s media ventures merger today. Thus, it is worth noting that the entire venture of the Trump Media & Technology Group whose principal product is the Truth Social platform, is going to be listed on the Nasdaq stock exchange quite soon.

Trump has contributed most through the purchase of the majority of shares or likely more than 79 million shares to MNSG. On top of the 6.7% outstanding Digital World common stock. $1 billion in value of the common stock is traded at the closing price of the stock at $36.94 on Friday.

This move comes at a time when the Republican presidential hopeful faces his most expensive legal battle: a 454 -million-dollar jury’s decision in connection with a case of fraud.

Though the implications of the developments in the avalanche shares deal won’t be realized in the immediate term unless the company’s board arranges for the reworking of the “lock-up” provision, it prevents the insiders from liquidating their newly issued shares for the next six months.

While Trump’s campaign press office did not respond at the moment to a request for comment, his tweet seemed to be timed to the news related to Cummings.

When a shell company that is listed on a public stock change agrees to acquire a private company, the target company actually changes places with the shell company, becoming traded when the merger is approved by shareholders. The market performance for Digital World indicates that if the situation with the Trump Media is any hint of a thing, the stockholders could find the ride to be bumpy.

Many of Digital World’s individuals were investors with smaller amounts of investments rather than substantial institutional and professional investors or Trump supporters. I am confident that there will be a significant increase of stock price value this year thanks to investors from these stakeholders that are led by the idea of merger. By next week, trading stocks also deteriorated by almost 14 percent.

The Presidential campaign in which Trump was involved did not end well his first time in the stock market. Trump Hotels and Casino Resorts attained publicity in 1995 (they would then adopt as their symbol the same DJT that like Trump Media will trade under). In 2004, banks which had placed loans towards his casino operations called a default on all debt, and the company was also delisted from the New York Stock Exchange.

The Friday’s approval put Digital World very away from the fact that its SEC filing presented many risks to its investors, just like Mu Media did after proceeding with its IPO.

On the one hand, the company believed that Trump, as a majority owner, could cast votes at shareholder meetings – but these votes may not be in the interest of all stakeholders. Verdict, Digital World mentioned a high percentage of failure of new social media platforms coupled with the expectation that Trump Media will be posting profits in the following years.

During the first 9 months of High Trump Media, the sector earned $3.4 million in revenue that was almost insufficient to cover the $37.7 million that became operational costs.

A vote by the shareholders of DWA on Friday has resulted in the nomination of a slate of seven individuals to the board of directors of Trump Media, including besgining with Donald Trump Jr. The other members are former politician and republican member, Devin Nunes, who serves as the company’s CEO; Robert Lighthizer, who was appointed as the U.S. trade representative by Trump; Linda McMahon, who ran the Small Business Administration in the Trump administration; and, Kash Young Patel, who worked on national security issues in the White House under Trump.

The Trump Media and Digital World Corporation announcement to amalgamate was made in October, last year. This deal does not only face federal probes, but, also, accompanies with numerous lawsuits before Friday’s ballot.

It has now been a year since Twitter and Facebook implemented major restrictions while also getting rid of the White Supremacist groups; Truth Social which was once known as X was then the name given to it after it rebranded itself following January 6th events which led to the storming of the Capitol building. For that reason, it has been back up since September, but it has not got the level of popularity it deserves due to competition from other alt tech rivals such as Parler, which was offline for a full year and is planning to reopen, and Gettr, which attracted fewer than 2 million visitors in the month of February.

Trump’s social media outlet’s entrance to Nasdaq brings with it this factor: the company gets bound to open up its financials once every three months with reports lodged with regulators.

Hence, like X competes with, Insincere also faces its share of the problems as prominent figures don’t want to be linked to the hate speech and some similar controversial content as well.